A Demat Account (Dematerialisation Account) is used to electronically store investments like shares, mutual funds, ETFs, bonds, and government securities, eliminating the need for physical paperwork.

Earlier, stocks were exchanged through physical certificates, which involved extensive paperwork and delays. To modernize trading, dematerialisation was introduced in 1996, converting physical shares into electronic form. This allowed faster and more efficient trading, aligning with global financial markets.

Use code – SU99681TJK

Open Free Demat Account

₹0 brokerage for first 30 days*

₹0 account maintenance charges for first year

₹0 commission on Mutual Funds

How to Open Demat Account?

Step 1

Fill up your information on the sign up form

Step 2

Enter OTP received on the registered mobile number

Step 3

Enter the KYC details

Step 4

Get Demat Account details on the registered Email ID

Why Open Demat Account with AngelOne

- Trust – Providing service to crores of customers since 1987

- Quick Onboarding -Fully digitised onboarding process. Provide your personal details, bank details and eKYC details.

- Simplified Trading – Invest with our user friendly platforms (Android/ IOS Apps or via desktop)

- Advisory – Our rule based investment advisory engine ARQ prime will assist you in making informed decisions

- Competent Brokerage – Enjoy Rs 0 brokerage on Equity Delivery and flat Rs 20 on intraday, F&O, Currencies & commodities

| Equity | Currency | Commodity | |

| Stock Investments | ₹0 brokerage upto ₹500 for first 30 days* Then lower of ₹20 or 0.1% per executed order, minimum ₹2 | ||

| Intraday Trading | ₹0 brokerage upto ₹500 for first 30 days* Then lower of ₹20 or 0.03% | ||

| Futures & Options | ₹0 brokerage upto ₹500 for first 30 days* Then, ₹20 per executed order | – ₹0 brokerage upto ₹500 for first 30 days* Then, ₹20 per executed order – ₹0 brokerage upto ₹500 for first 30 days* Then, ₹20 per executed order | ₹0 brokerage upto ₹500 for first 30 days* Then, ₹20 per executed order ₹0 brokerage upto ₹500 for first 30 days* Then, ₹20 per executed order |

Advantages of a Demat Account

- Convenience: Trade multiple securities like shares, bonds, ETFs, IPOs, etc., through a single account with no paperwork.

- No Offline Trading Hassles: SEBI restricts physical trading to 500 shares due to inconvenience.

- Auto Sync: Transactions reflect in real-time.

- Security: Eliminates risks of fraud or loss of physical certificates.

- Accessibility: Track and manage investments anytime, anywhere.

- Zero Balance Opening: No minimum balance required.

Key Terms in Demat Account

- Depository: Entities like CDSL and NSDL hold securities on behalf of investors.

- Depository Participant (DP): Agents like banks and brokers facilitate transactions.

- Portfolio Holding: Tracks investments with details like price and quantity.

- Unique ID: A 16-digit number used for transactions.

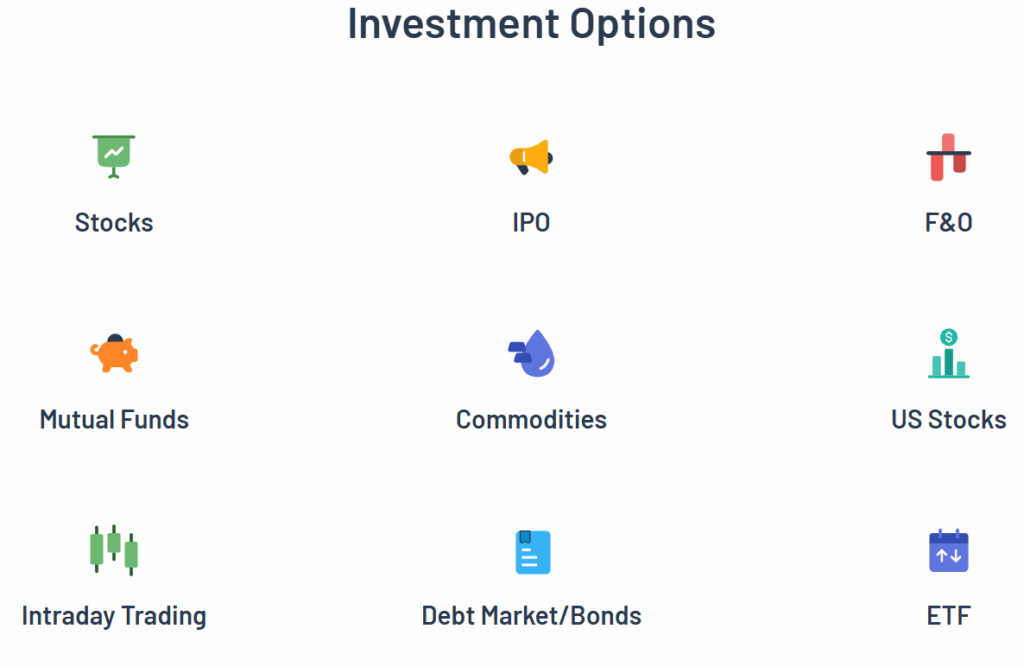

Trading Options Available

- Stock Investments: Buy/sell shares on NSE & BSE.

- Intraday Trading: Short-term trading for quick returns.

- Mutual Funds & IPOs: Invest in professionally managed funds and company IPOs.

- Futures & Options: Derivative trading for hedging risks.

- Currency & Commodity Trading: Trade forex and commodities on MCX & NCDEX.

- Margin Trading: Leverage investments with up to 5x margin.

- Exchange Traded Funds (ETFs): Trade index-based funds.

How to Open a Demat Account

- Submit personal details and verify via OTP.

- Select a Depository Participant (DP).

- Complete eKYC and upload required documents (PAN, ID proof, address proof).

- Undergo verification and pay necessary charges.

- Once approved, the account is activated.

Facilities of a Demat Account

- Transfer of Investments: Move shares easily using a Delivery Instruction Slip (DIS).

- Dematerialisation & Rematerialisation: Convert shares between physical and electronic forms.

- Loan Facility: Use securities as collateral for loans.

- Corporate Actions: Auto-updates for stock splits, bonuses, etc.

- Freezing Option: Temporarily freeze the account for security.

- Speed E-Facility: NSDL allows e-slip transactions.

Things to Consider Before Opening a Demat Account

- Required Documents: PAN, Aadhaar, passport, utility bills, bank details.

- Charges: Includes account maintenance, transaction fees, and SEBI taxes.

- Trading Account Linkage: Helps in seamless transactions.

- Nomination: Assign a nominee for easy future access.

Additional Features

- Portfolio Consolidation: Merge investments under a single portfolio.

- Different Account Types: Open accounts for individuals, minors, or corporates.

- No Minimum Balance: No requirement to hold securities to maintain an account.

No Comments

Leave Comment